|

MAP - 'Lettres du Maghreb': Vernissage d'une exposition collective des arts plastiques à Oujda

Oujda-19,avril,2024-(MAP)-Une exposition collective des arts plastiques,intitulée "L'écriture visuelle et le temps",a été inaugurée jeudi soir à la Galerie d’arts Moulay El Hassan de Oujda, ... |

|

MAP - 4ème édition du Salon maghrébin du Livre: Cérémonie d’hommage posthume à Abdelkader Retnani

Oujda -19 avril 2024- (MAP) - Une cérémonie d'hommage posthume à l'éditeur marocain Abdelkader Retnani a été organisée jeudi soir à la Bibliothèque régionale d’Oujda,... |

|

ANSA - مارينا برامبيلا أول عميدة لجامعة ستاتالي في ميلانو

(أنسامد) - أبريل 19 - روما - تم انتخاب مارينا مارزيا برامبيلا كأول امرأة عميدة لجامعة ستاتالي الحكومية في ميلانو يوم الخميس.

برامبيلا، 58 عاما، محاضرة باللغة الألمانية وتشغل حتى الآن منصب نائب العميد لخدمات التدريس والطلاب، وهي أول رئيسة في تاريخ المعهد في ميلانو،... |

|

ATA - Naval Force contingent dispatches to Aegean Sea on a patrol mission

TIRANA,April,19/ATA/The new contingent of troops of the Albanian Naval Force was dispatched to the Aegean Sea on a patrol mission.

Minister of Defense Niko Peleshi said... |

|

NNA - مزارعون من أبناء البترون في مؤسسة MELKART HONEY

وطنية-البترون-زارت مجموعة من المزارعين من أبناء بلاد البترون،وفي إطار مشروع مدارس إدارة الأعمال الزراعية الممول من منظمة الفاو،وبمسعى من المهندس داني باسيل،رئيس المركز الزراعي في البترون،مؤسسة Melkart Honey التي تتعاطى بتربية النحل وبيع منتجاته (عسل على أنواعه-حبوب لقاح-عكبر-خل العسل- طرود نحل ملكات نحل-كريم للبشرة وغيره).... |

|

MAP - La jeunesse et la culture au cœur du projet de développement au Maroc (M. Bensaid)

Rabat - 19 avril 2024 - (MAP) - La jeunesse et la culture sont deux composantes essentielles au cœur du projet de développement au Maroc,... |

|

MAP - Sénégal: le Maroc présent au 6ème festival 'Films femmes Afrique'

Dakar-19,avril,2024-(MAP)-La sixième édition du festival "Film femmes Afrique" (FFA), organisé cette année sous le thème "Urgence climatique et paix", s’ouvre le 26 avril à Dakar,... |

|

ANSA - Young Italians march to 'take back the future' amid the climate crisis Fridays for Future demos in Italy's major cities

Young people took to Italy's streets on Friday to demand action to address the environmental crisis as part of the latest Global Climate Strike staged... |

|

ANSA - كرة قدم: دي روسي يستمر في تدريب روما

(أنسامد)- أبريل 19 - روما - أعلن دان فريدكين، رئيس نادي روما وابنه ريان في بيان الخميس، أن دانييلي دي روسي سيبقى في منصبه كمدرب لفريق روما.

وتم تعيين أسطورة النادي ولاعب خط الوسط الإيطالي السابق في منصبه كمدرب للفريق في يناير عندما أقيل جوزيه مورينيو.... |

|

NNA - Mounira Al Solh takes over Lebanon pavilion at la Biennale Arte 2024 with a major multimedia installation

NNA-The Lebanese Pavilion at the 60th International Art Exhibition–La Biennale di Venezia,has inaugurated"A Dance with her Myth",a major multimedia installation by artist Mounira Al Solh.... |

|

NNA - مؤتمرفي الكسليك عن 'إعادة التفكير باللغات والآداب والتعليم في عصر الذكاء الاصطناعي'

وطنية-نظمت كلية الآداب والعلوم في جامعة الروح القدس-الكسليك، برعاية وزارة التربية والتعليم العالي، مؤتمرًا بعنوان "إعادة التفكير باللغات والآداب والتعليم في عصر الذكاء الاصطناعي". يتخطّى هذا المؤتمر،بحسب بيان، كونه لقاء أكاديميًا، فهو يشكّل منصة لتسليط الضوء على الأفكار الابتكارية ونسج حوار حول دور الذكاء الاصطناعي... |

|

MAP - ComediaBlanca: de grands noms de l'humour débarquent à Casablanca

Casablanca -19 mai 2024-(MAP) - La première édition du festival ComediaBlanca, prévue le 17 et 18 mai à Casablanca, promet de rassembler de grands noms... |

|

MAP - Aéronautique : Le gouvernement engagé à soutenir le développement des compétences (Ministre)

Casablanca -19 avril 2024-(MAP)– Le gouvernement est engagé à soutenir la formation et le développement des compétences nécessaires à la croissance du secteur de l'aéronautique,... |

|

ANSA - Armani not ruling out merger or IPO

I don't exclude anything fashion designer tells Bloomberg

Giorgio Armani has said his fashion group could undergo major changes when he is no longer at the helm,saying he was not ruling out ... |

|

ANSA - صاحب مطعم 'يستأجر' الروبوتات لتقديم الطعام لعدم وجود موظفين

(أنسامد)-أبريل 19- روما - استأجر صاحب مطعم على ساحل أمالفي، روبوتين صينيين الصنع للخدمة على الطاولات وتقديم الطعام بعد فشله في تعيين عدد كاف من الموظفين.

وقال ماريو بارلاتو، صاحب مطعم La Terrazza delle Sirene في سورينتو، إنه "سئم" من الشباب الذين يطلبون عطلة نهاية الأسبوع،... |

|

NNA - UNIFIL, Majdal Slim municipality collaborate on tea plantation project: nepalese peacekeepers and local officials jointly cultivate new economic opportunity

NNA-The commanding officer of UNIFIL’s Nepalese contingent, Lt. Col.Arjun Bikram Thapa, Mayor of Majdal Slim Ali Tamer Yassine, and the Nepalese civil-military cooperation team jointly... |

|

NNA - 'همسات الهوس' بريشة ميشلين نهرا في الجميزة

وطنية - افتتحت الرسامة ميشلين نهرا معرضها الفردي الثاني بعنوان "همسات الهوس"، في Atelier Maher Attar في الجميزة، ويستمر حتى 23 الحالي.

وتضمن المعرض 25 لوحة فنية أكدت من خلالها الرسامة نهرا أن "الفن قادر على ترجمة ما في داخل الإنسان خلال مراحل حياته المختلفة ومحطاته... |

|

MAP - RAM et Safran renforcent leur partenariat dans la maintenance des moteurs d’avion

Casablanca -19 avril 2024-(MAP)- Royal Air Maroc (RAM) et Safran ont signé, jeudi à Casablanca, un mémorandum d'entente (MoU) pour le renforcement de leur partenariat... |

|

MAP -Water Management: Morocco Has Rich Experience to Share with Other Countries (FAO DG)

Rabat-April 19,2024-(MAP)-Morocco, under the leadership of HM King Mohammed VI, has rich experience in water management, Director-General of the UN Food and Agriculture Organization (FAO),... |

|

ANSA - طبعة 2024 من كتاب 'في المطبخ..لا أهدر'

(أنسامد) -أبريل 18- روما - صدرت الطبعة الحديثة 2024 من كتاب الطبخ لمكافحة الهدر "فى المطبخ..لا أهدر" من تأليف مؤسسة بنك الطعام.

وتهدف المبادرة التي تم تنفيذها بالتعاون مع المعهد الفندقى في أسيزى لتكوين حليفاً فى المطبخ لضمان أن المكونات المتبقية فى الثلاجة سيتم إعادة استخدامها.... |

|

ANSA - Soccer: Italy guaranteed 5 teams in next Champions League - Top spot of UEFA ranking consolidated with three teams in semis

Italy will have five teams in next season's Champions League after AS Roma and Atalanta's qualification for the semi-finals of the Europa League and Fiorentina... |

|

NNA - مشاركة فاعلة لجمعية الصناعيين في معرض 'هوريكا'

وطنية - شاركت جمعية الصناعيين اللبنانيين برئاسة سليم الزعني بشكل فاعل، في الملتقى السنوي لصناعتي الضيافة والخدمات الغذائية "هوريكا" الذي اقيم في "سيسايد ارينا"، عبر حضورها القوي داخل المعرض وتنظيمها فعاليتين مميزتين هما:Meet the buyers وInnovation. ... |

|

NNA - الفرانشايز اللبناني يساهم في النهوض الاقتصادي عبر حيويته وانتشاره الواسع

وطنية-نظمت الجمعية اللبنانية لتراخيص الامتياز منتدى BIFEX Talks خلال معرض "هوريكا" (١٦-١٩ نيسان ٢٠٢٤) "بهدف ابراز حيوية قطاع الفرانشايز اللبناني،الذي حقق نجاحات مدهشة،عبر الانتشار الواسع في الدول العربية والاجنبية، وذلك على الرغم من الازمات المتتالية منذ العام ٢٠١٩"،وفق بيان عن الجمعية. ... |

|

MAP - Food Security: Morocco Highlights Its Experience at ARC33

Rabat-April.19,2024-(MAP)-Minister of Agriculture, Fisheries, Rural Development, Water and Forests, Mohamed Sadiki,highlighted, here Thursday,Morocco's experience in the resilience of its agricultural system for sustainable food security.... |

|

MAP - Morocco, Regional Model for Transformation of Agrifood Systems (FAO DG)

Rabat - April 19, 2024 - (MAP) - Morocco is a leading regional model for the transformation of agrifood systems, said, on Thursday in Rabat,... |

|

ANSA - إيطاليا..جيل الألفية: أبطال جدد فى سوق الفن

(أنسامد) - أبريل 18 - روما - أكد تقرير خاص لشركة ديلويت برايفت للخدمات زيادة عدد المشترين الذين تقل أعمارهم عن 40 عاماً والذين يفضلون فنانى الألفية المعاصرين بالاضافة إلى اقتناء السلع الفاخرة بما فى ذلك الحقائب والمجوهرات . ... |

|

ANSA - Soccer: Roma, Atalanta on course to meet in UEL final - 10-man Roma oust Milan, Bergamo side knock out Liverpool

AS Roma and Atalanta are on course for an all-Italian final in the UEFA Europa League after knocking out soccer giants AC Milan and Liverpool... |

|

NNA - وزارة الشؤون أطلقت المعايير الوطنية لدور الحضانة بالشراكة مع 'لجنة الإنقاذ الدولية'

وطنية - أطلقت وزارة الشؤون الاجتماعية بالشراكة مع لجنة الإنقاذ الدولية – 'IRC'، 'معايير دور الحضانة التابعة لوزارة الشؤون نحو بيئة إنمائية آمنة وصديقة للأطفال' بدعم من مؤسسة ليغو "LEGO Foundation" ومؤسسة ماك آرثر "MacArthur Foundation"،في حضور ممثلين عن الوزارات والادارات الحكومية، السفارات ، ... |

|

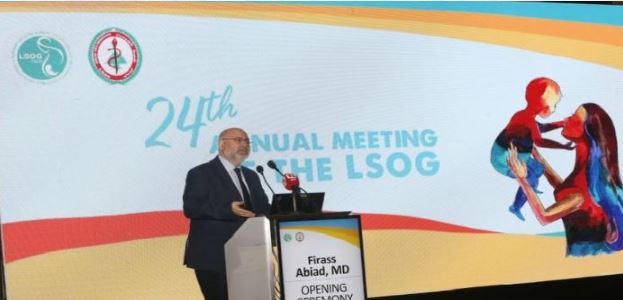

NNA - افتتاح المؤتمر السنوي للجمعية اللبنانية للتوليد والأمراض النسائية

وطنية - أعلن وزير الصحة العامة في حكومة تصريف الاعمال الدكتور فراس الأبيض "أن التعرفة الجديدة للأطباء محقة وعادلة ارتفعت إلى ثمانين في المئة من قيمة تعرفة ما قبل الأزمة|، مجددًا التأكيد "أن اليد مفتوحة لإيجاد حل لكل المشاكل التي لا يمكن حلها بالإعلام". ... |

|

CNA - Tourism Minister optimistic for similar results as last year despite challenges

Deputy Minister for Tourism Costas Koumis said he is optimistic that tourist arrivals in 2024 will equal the numbers registered last year, despite geopolitical crisis... |

|

Lusa - Business News - Portugal: Lisbon stock market index ends day down 0.5% as BCP shares fall 2.8%

Lisbon, April.19,2024(Lusa)- The Lisbon stock market closed the day's session down on Friday, with the benchmark PSI (Portugal Stock Index) dropping 0.51% to 6,295.12 points,... |

|

Lusa - Business News - Portugal: Unemployment in March falls 1.9% on month, up 6.0% on year - IEFP

Lisbon,April.19,2024(Lusa)-The number of unemployed people registered at job centres in Portugal fell by 1.9% in March from February,to 324,616, but that was up 6.0% year-on-year,... |

|

Lusa - Business News - Portugal: Electric charger operator MOBI.E signs Iberia MoU wth Italy's Atlante

Lisbon, April.19,2024 (Lusa) - MOBI.E, the state-owned company that acts as Portugal's Electric Mobility Network Managing Entity (EGME), and Atlante, part of Italy's NHOA group,... |

|

Lusa - Business News - Guinea-Bissau: Rice prices set to soar after government ends 'unaffordable' subsidies

Bissau,April.19,2024(Lusa)-The price of rice in Guinea-Bissau is set to skyrocket after the country's government ended a state subsidy aimed at moderating the cost to the... |

|

Lusa - Business News - Portugal: Cuts in personal income tax mean €348M in relief this year, €115M next

Lisbon, April.2024(Lusa)- Proposals aproved by Portugal's right-centre government to reduce personal income tax (IRS) rates this year will bring additional relief of €348 million, ... |

|

Lusa - Business News - Portugal: Additional tax cuts for under-35s to be unveiled 'in due course' - PM

Lisbon, April.19,2024(Lusa) - Portugal's prime minister, Luís Montenegro, said on Friday that the government's proposal for the IRS Jovem special rates of personal income tax... |

|

Lusa - Business News - Portugal: New withholding tables for personal income tax in force by July - PM

Lisbon, April 19, 2024 (Lusa) - Portugal's prime minister said on Friday that he expects the new withholding tax tables for personal income tax (IRS)... |

|

Lusa - Business News - Portugal/CPLP: Swapping debt for green investment 'only complementary' - IMF

Washington, April 19, 2024 (Lusa) - The International Monetary Fund (IMF) economist responsible for coordinating its latest report on sub-Saharan Africa argued on Friday ... |

|

Lusa - Business News - CPLP: No excessive premium on debt yields of sub-Saharan countries - IMF

Washington, April 19, 2024 (Lusa) - The International Monetary Fund economist responsible for the institution's latest report on sub-Saharan Africa said on Friday ... |

|

Lusa - Business News - CPLP: Outlook for sub-Saharan Africa improved but risks remain - IMF economist

Washington, April 19, 2024 (Lusa) - The International Monetary Fund economist who coordinated its latest report on sub-Saharan Africa, released on Friday, ... |

|

CNA - المتحدث الرسمي: ليس لدى الحكومة علم بشأن الصواريخ المرسلة إلى إسرائيل عبر قبرص

قال المتحدث باسم الحكومة كونستانتينوس ليتيمبيوتيس اليوم الجمعة في معرض رده على سؤال حول التقارير الصحفية الإسرائيلية التي تفيد بأن الصواريخ الأمريكية تم نقلها إلى الدولة المجاورة، بأن الحكومة القبرصية ليس لديها معلومات بشأن الصواريخ المرسلة إلى إسرائيل عبر قبرص ولم يتم منح أي إذن... |

|

Lusa - Business News - Portugal: European values under threat; Europe stronger than ever - EP president

Lisbon, Aprl 19,2024 (Lusa) - The president of the European Parliament, Roberta Metsola, warned on Friday in Lisbon that European values are increasingly under threat,... |

|

Lusa - Business News - Portugal: Government approves proposed income tax cuts worth €1.539 - PM

Lisbon, April.19,2024(Lusa) - Portugal's government on Friday approved in cabinet a proposal to reduce personal income tax (IRS) rates up to the eighth income bracket,... |

|

Lusa - Business News - Portugal: Government to recover proposal to regulate lobbies

Brussels, April.19,2024 (Lusa) - Portugal's prime minister has announced that the government will revive the proposal from the previous legislature to regulate lobbying in Portugal,... |

|

Lusa - Business News - Portugal: Far-right party calls state secretary compensation 'immoral'

Lisbon, April.19,2024(Lusa)-Chega believes that the compensation received by the secretary of state for mobility when she left CP is "immoral" and that parliament is facing... |

|

CNA - CySEC imposes €360,000 in fines to Intelifunds

The Cyprus Securities and Exchange Commission(CySEC) has announced a decision to impose fines amounting to €360,000 on the Cyprus Investment Firm(CIF) MCA Intelifunds(the board decision).... |

|

Lusa - Business News - Angola: USAID leader to discuss malaria, Lobito corridor

Washington,April.19,2024(Lusa)- The administrator of the US Agency for International Development (USAID) and the US Assistant Secretary of State for Management will visit Angola next week,... |

|

Lusa - Business News - Portugal: 'End fossil' movement protests at environment ministry

Lisbon, April 19,2024 (Lusa) - Students from the "End Fossils" movement said in a statement released on Friday that they were protesting at the Ministry... |

|

Lusa - Business News - Portugal: Robust reduction in natural gas use, consumption cut by almost 23%

Lisbon,April.19,2024(Lusa)-Portugal exceeded by 50.7% the European target of a 15% reduction in natural gas consumption set out in the plan in force between August 2022... |

|

Lusa - Business News - Portugal: EDP Renováveis completes sale of Canada windfarm

Lisbon,April.19,2024(Lusa)-EDP Renováveis has finalised an agreement with CC&L Infrastructure for the sale of an 80% stake in a 297 megawatt (MW) wind project in Alberta,... |

|

CNA - وزيرة الدولة للنقل البحري تؤكد على أهمية وجود مركز الكومنولث للتميز في قبرص

أكدت وزيرة الدولة للنقل البحري مارينا هادجيمانوليس على أهمية مركز التميز للكومنولث، الذي سيتم إنشاؤه بعد توقيع مذكرة تفاهم في وقت لاحق من اليوم الجمعة بين جمهورية قبرص والكومنولث والمعهد البحري القبرصي. ... |

|

CNA - البرلمان القبرصي يطالب الحكومة والاتحاد الأوروبي باتخاذ إجراءات محددة بشأن الهجرة

أصدرت الجلسة العامة لمجلس النواب القبرصي التي ناقشت يوم الخميس القضية الملحة للهجرة، قراراً يدعو الحكومة والاتحاد الأوروبي إلى اتخاذ إجراءات ملموسة فيما يتعلق بأزمة الهجرة المستمرة. ... |

|

Lusa - Business News - Portugal: Stock market opens lower with Mota-Engil falling more than 2.5%

Lisbon, April 19, 2024 (Lusa) - The Lisbon stock market was trading lower on Friday, with Mota-Engil shares falling 2.57% to €4.17. ... |

|

Lusa - Business News - Portugal: Albufeira considers regulating ride-hailing vehicles

Albufeira, Portugal, April 19,2024 (Lusa) - Albufeira town council is considering regulating the pick-up and drop-off of passengers in the city centre during the summer... |

|

Lusa - Business News - Portugal: Occasion made decision for president to end legislature - former PM

Lisbon, April,19,2024(Lusa)- Former Prime Minister António Costa believes that the "occasion made the decision" for the president of Portugal to end the previous legislature "prematurely"... |

|

Lusa - Business News - Portugal: Nationals represent 30% of Web Summit workers - vice-president

Rio de Janeiro,Brazil,April.19,2024(Lusa)-The Portuguese already make up around 30% of the Web Summit company's workforce and have been instrumental in internationalising the brand in cities... |

|

Lusa - Business News - Portugal: Criminalising illicit enrichment 'difficult' - association

Lisbon,April19,2024(Lusa)-The criminalisation of illicit enrichment "can be useful" in the fight against corruption, but turning it into law in a form that "passes the sieve"... |

|

CNA - قبرص تستضيف اجتماع وزراء محيط الكومنولث

يعقد اليوم الجمعة في بافوس الاجتماع الافتتاحي لوزراء محيط الكومنولث الذي يحمل شعار "محيطنا المشترك المرن: من قبرص إلى ساموا"، حيث سيشارك في الاجتماع وزراء وكبار المسؤولين من الدول الأعضاء في الكومنولث. ... |

|

Lusa - Business News - Portugal: Top newspaper headlines on Friday, 19 April

Lisbon,April 19,2024(Lusa)-Operation Influencer involving former PM Costa is on the front pages of several newspapers on Friday as controversy surrounds the speed of the case.... |

|

Lusa - Business News - Portugal: PM rejects banking fund idea of one capital injection into Novo Banco

Bragança, Portugal, Feb. 27,2020 (Lusa)–Portugal’s prime minister, António Costa, on Thursday ruled out the idea of a single capital injection into Novo Banco, successor institution to Banco Espírito Santo, as floated by the president of the banking sector Resolution Fund.

Instead, the prime minister said, the state will inject only up to a maximum of €850 million.

On Wednesday, Máximo dos Santos, the president of the Resolution Fund said that Novo Banco would request a further €1.037 billion relative to 2019 to boost its capital, saying that at the time there had been "receptivity in the abstract" to the idea of a single up-front injection.

Testifying to parliament’s budget and finances committee, having been called at the request of the Left Block (BE), dos Santos argued that an early end to the contingency capitalisation mechanism for the bank "would have the effect of reducing uncertainty and increasing visibility", so that "there was receptivity in the abstract" to the idea of a single capital injection, "from both the Resolution Fund and from Novo Banco, as well as from [majority shareholder] Lone Star and also the government, with whom there have been meetings."

The prime minister, though, took a different line.

"The state will contribute solely and exclusively with what is [foreseen] in the state budget and … approved by parliament and will contribute, and I reiterate, in a form of loan, as has been [the case] until now," Costa told journalists on the way in to a cabinet meeting that was to take place in Bragança as part of a decentralised government initiative.

According to the prime minister, part of the conditions of sale of the stake to Lone Star was a maximum ceiling on the amount that the Resolution Fund could contribute and, on the other hand, that each year the state budget sets a maximum for loans by the state.

"Therefore, the loan that this year the state will grant to the Resolution Fund is the one in the Resolution Fund for 2020, that is 850 million euros," Costa said, reiterating once more that this was a loan that the fund would have to pay back to the state in the long term.

In 2017, a 75% stake in Novo Banco was sold to Lone Star Fund of the US, with the remaining 25% remaining with the Resolution Fund, a state-sector entity managed by the Bank of Portugal to whose capital banks based in Portugal are obliged to contribute.

Novo Banco has requested tax credits from the state in respect of deferred tax assets - resulting from the difference between accounting costs with impairments or provisions and costs recognised for tax purposes - for the years in which it has losses, under rules in force between 2014 and 2016.

The use of deferred tax assets by any bank requires that a deposit in the state’s name be set up, worth 110% of the tax credit in question, and which the state can convert into shares,so becoming a shareholder of the bank that uses this scheme and diluting the position of the other shareholders.

In September last year, Novo Banco estimated that the state would be able to retain up to 10% of its capital.

In January, Mariana Mortágua, a BE deputy, in comments in parliament, estimated the value of capital injections made by the state in Novo Banco under the deferred tax asset regime at over €500 million.

According to Mortágua, under this scheme Novo Banco had asked the state for €154 million in 2015 (which were paid in 2017), a further €99.5 million in 2016 (paid in 2018) and €136 million euros in 2017 (which were to have been paid in 2019 but were not and should be paid this year, as there is an amount of €130 million pencilled into the 2020 state budget). In addition, there is a further €162 million that Novo Banco requested in 2018.

On Wednesday, the BE announced that it will table a legislative initiative to ensure that "not a penny more will enter Novo Banco without an audit of its accounts and the treatment of credits originating from BES being known."

VSYM/ARO // ARO.

Lusa

Agency : LUSA Date : 2020-02-28 09:04:00

|