|

NNA - UNDP and the Ministry of Social Affairs launch of the first edition of the wheelers wheelchair basketball championship

NNA- The United Nations Development Programme (UNDP), in partnership with the Ministry of Social Affairs and with funds from Germany through KfW Development Bank launched... |

|

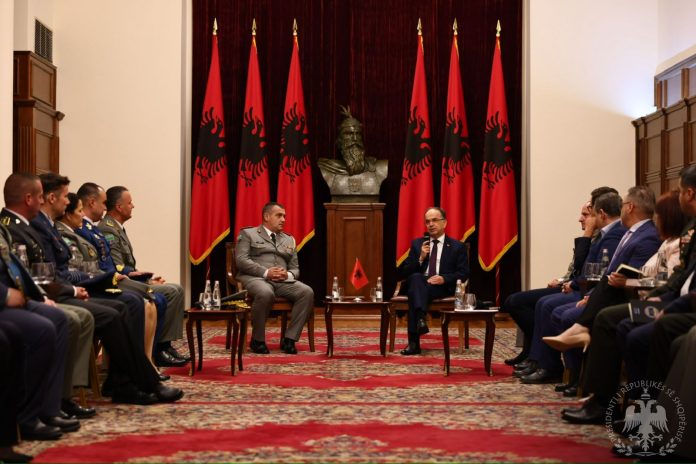

ATA - Begaj: Albania, promoter of peace and security in region

TIRANA, April 22 /ATA/ 'Albania promotes peace and security in the region and beyond through the policy of dialogue, cooperation and understanding.' ... |

|

ANSA - Paris 2024: Tamberi, Arrigo flag bearers for Italy

High jumper and fencer to carry tricolour at opening ceremony

Olympic high jump champion Gianmarco Tamberi and fencing great Arianna Errigo will be Italy's flag bearers at the Paris2024 Olympic Games,Italian Olympic Committee(CONI) President Giovannii... |

|

ANSA - معرض للمصور ماسيمو بالديني في رافينا

(أنسامد) - أبريل 22 - روما - تستضيف مؤسسة سابي Sabe للفن في مدينة رافينا الإيطالية معرضا للمصور الفوتوغرافي ماسيمو بالديني في الفترة من 20 أبريل إلى 30 يونيو.

يقام المعرض بعنوان "زيارة إيطاليا مجددا.

عينات من الصور" برعاية كلاوديو مارا وبالتعاون مع أكاديمية الفنون الجميلة. ... |

|

NNA - Ministry of Justice, European Union, and UNICEF launch first e-learning program to enhance capacities of judges on juvenile justice

NNA– The Ministry of Justice, in the framework of a project funded by the European Union and implemented by UNICEF, launched the “On Juvenile Justice”,... |

|

ANSA - إيطاليا : ارتفاع تكلفة عطلة الربيع عن العام الماضي

(أنسامد) - أبريل 22 - روما - من المتوقع أن ترتفع تكلفة قضاء عطلة الربيع فى إيطاليا بحوالي 10.5% عن العام الماضي بسبب الزيادات الحادة في الأسعار والرسوم في قطاعي السياحة والنقل، مع زيادة في الإنفاق بإجمالي 780 مليون يورو عن عام 2023. ... |

|

ANSA - Soccer: Cannavaro takes over Udinese till end of season Serie A strugglers sack Cioffi

Serie A strugglers Udinese said Monday that they have put Fabio Cannavaro in charge until the end of the season after sacking coach Gabriele Cioffi.... |

|

NNA - الجامعة اللبنانية الاميركية تحتفل بطلاب مشاريع CAPSTONE 2024 في مبادرة الشراكة الامريكية الشرق الاوسطية (MEPI)

وطنية - احتفلت الجامعة اللبنانية الاميركية (LAU) و'مبادرة الشراكة الأمريكية الشرق الأوسطية - رواد الغد برنامج المنح الدراسية (MEPI-TL)' في الوكالة الاميركية للتنمية الدولية بـدفعة جديدة ضمت 16 من الطلاب اللبنانيين والعرب قدموا مشاريع ضمن إطار يطلق عليه أسم “Capstone Project”، ... |

|

ANSA - Inter to wear 'Ext1nction Numb3rs' for Earth Day Club, WWF team up to say climate, biodiversity crises affect all

Inter and WWF Italia have teamed up for an Earth Day initiative to show that the environmental crisis affects everyone and needs addressing, ... |

|

ANSA - معرض عن هنري دو تولوز-لوترك في تورينو

(أنسامد) - أبريل 22 - روما - تستضيف مدينة تورينو الإيطالية معرضا عن الفنان والرسام الفرنسي هنري دو تولوز-لوترك بعنوان "تولوز-لوترك، عالم السيرك ومونمارتر" في مبنى ماستيو ديلا سيتاديلا التاريخي. ... |

|

NNA - Massive fire erupts in Syrian refugee camp near Zahle, civil defense teams rush to the scene

NNA-A massive fire broke out on Monday in a Syrian refugee camp near Al-Rehab complex in Zahle, Bekaa, prompting civil defense teams from all centers... |

|

ANSA - عرض أزياء مجموعة جوتشي كروز الجديدة في لندن في مايو

(أنسامد) - أبريل 22 - روما - أعلنت دار جوتشي الإيطالية للأزياء الراقية، أن عرض أزياء مجموعة غوتشي كروز 2025 سيقام في لندن يوم 13 مايو القادم، موضحة أن العرض سيقام في متحف تيت مودرن.

يتمتع متحف تيت مودرن بامتلاكه مشهدا ثقافيا ديناميكيا في لندن، ... |

|

ANSA - اختتام معرض فيتشنزا للسيارات الكلاسيكية

(أنسامد) -أبريل 22- روما - اختتمت النسخة الأولى من معرض فيتشنزا للسيارات الكلاسيكية والذى افتتح يوم الجمعة الماضى فى ميلانو .

وقد شاركت فيه مجموعة من المعارض الإيطالية بعدد من السيارات الكلاسيكية والرياضية حيث شهد اقبالاً كبيراً فى منطقى الاحتفالات بالجناح 7 من معرض فيتشنزا كلاسيكا.... |

|

Lusa - Business News - Portugal: Stock market soars on Galp oil find, up 3.5% to 6,515.47 points

Lisbon, April,22,2024 (Lusa) - The Lisbon stock market closed higher today, with the PSI index rising 3.50% to 6,515.47 points, the highest since November 2020,... |

|

Lusa - Business News - Angola: Brazil embassy resolves tourist visa delay

Luanda, April.22,2024 (Lusa) - The Brazilian embassy in Luanda has announced that it has delivered all the applications for tourist visas that were under analysis... |

|

Lusa - Business News - ÇPortugal: Galp shares boost stock market after discovery disclosure

Lisbon,April.22,2024(Lusa)—Analysts consulted by Lusa said on Monday that the rise in Galp's share price is a natural reaction to the significant commercial discovery in Namibia... |

|

CNA - لقب الدوري القبرصي لكرة القدم تحدد بين فريقي أبويل وآيك

يتنافس فريقا أبويل من نيقوسيا وأيك من لارنكا على لقب الدوري القبرصي سيتا لكرة القدم.

بعد الجولة الثامنة من المرحلة الثانية من المجموعة الأولى وقبل مباراتين فقط على نهاية الدوري، استطاع الفريقين البقاء في المركزين الأولين في الترتيب. ... |

|

Lusa - Business News - Portugal: Madeira hotels almost fully sold out for May flower festival

Funchal, Portugal, April 22,2024 (Lusa) - Hotel occupancy in Madeira is expected to be around 95% during the Flower Festival, between 2 and 26 May,... |

|

Lusa - Business News - Portugal: Wine exports to Brazil to rise 10% in value in 2024 - association

São Paulo, Abril.22,2024(Lusa) - Exports of wine from Portugal to Brazil are expected to grow by 5% in volume and 10% in value by 2024,... |

|

Lusa - Business News - Portugal: Douro winegrowers call for halt to new vine planting

Vila Real,Portugal April.22,2024(Lusa)-'Associações do Douro' a local association in the Douro valley region of northern Portugal has called for stringent conditions on planting new vine,... |

|

Lusa - Business News - Portugal: Amount invested in savings certificates falls for fifth month, below €34B

Lisbon, April 22, 2024 (Lusa) - The amount invested in savings certificates (CAs) issued by Portugal's government in March fell to €33.9956 billion, ... |

|

Lusa - Business News - Portugal: Azores region guide for hiring foreign nationals welcomed by business

Ponta Delgada, Portugal, April,22,2024 (Lusa) - The government of Portugal's Azores region has published a guide for hiring foreign citizens that contains what it said... |

|

Lusa - Business News - Angola: Economic growth was 0.9% last year, better than previous estimate - IMF

Washington, April 22, 2024 (Lusa) - The International Monetary Fund economist who coordinated the institution's latest economic reports on sub-Saharan Africa told Lusa on Monday... |

|

Lusa - Business News - Portugal: All parties ready to agree on measures to combat corruption - minister

Lisbon,April,22,2024(Lusa)- Portugal's minister of justice said on Monday that all the parties with seats in parliament have told her that they are willing to agree... |

|

Lusa - Business News - Portugal: Fruit producers in Oeste propose region-wide water management project

Alcobaça, Portugal, April 22, 2024 (Lusa) - The Alcobaça Apple Producers Association, in Portugal's Oeste (West) region, wants to bring together farmers and local authorities... |

|

Lusa - Business News - Macau/CPLP: China, Portuguese-language world to explore new areas of cooperation

Macau, China, April 22, 2024 (Lusa) - China and Portuguese-language countries want to explore new areas of cooperation, such as the digital and blue economies,... |

|

Lusa - Business News - Portugal: Debt management key pillar of economic policy since 1974 - analysts

Lisbon, April 22, 2024 (Lusa) - The management of public debt in Portugal became a fundamental pillar of economic policy after the country's 1974 Revolution,... |

|

Lusa - Business News - Portugal: Authority fines supermarkets €76,900 in three years for misleading ads

Lisbon, April 22, 2024 (Lusa) - Portugal's Directorate-General for Consumers (DGC) imposed total fines of €76,900 on supermarkets for misleading advertising between 2020 and 2024,... |

|

Lusa - Business News - Angola: Country 'at standstill' due to second phase of general strike - unions

Luanda,April,22,2024(Lusa)-Angola's workforce has come to a "complete standstill" at the start of the second phase of the general strike called by the country's main trade... |

|

Lusa - Business News - Angola: Three diamonds from Lulo mine totalling 361 carats auctioned for $10.5M

Lisbon, April 22, 2024 (Lusa) - Three diamonds from Angola's Lulo mine, totalling 361 carats, were sold at auction for $10.5 million (around €10 million),... |

|

CNA - الرئيس خريستوذوليديس: الجانب القبرصي اليوناني لديه خطة لتحقيق نتيجة إيجابية في المشكلة القبرصية

قال رئيس الجمهورية نيكوس خريستوذوليديس اليوم الاثنين في تصريحاته فبيل حدث نظمته منظمة الشباب القبرصي، إن الجانب القبرصي اليوناني لديه خطة محددة حول كيفية خلق حقائق إيجابية للجميع فيما يتعلق بالمشكلة القبرصية. ... |

|

CNA - رئيسة مجلس النواب تؤكد على ضرورة أن تكون مشاركة المرأة في القرارات على قدم المساواة

أكدت رئيسة مجلس النواب أنيتا ديميتريو على ضرورة التضامن وتوعية المجتمع المدني بالقضايا المتعلقة بالمشاركة المتساوية للمرأة في مراكز صنع القرار. ... |

|

Lusa - Business News - Angola: Bar association to ensure workers' rights during strike

Luanda, April 22,2024 (Lusa) - The Angolan Bar Association has called for the creation of teams to monitor the second phase of the general strike,... |

|

Lusa - Business News - Portugal: Energy company shares close to all-time high after Namibia oil find

Lisbon,April 22,2024(Lusa)-Shares in oil company Galp continued to rise by more than 17.3%,to €18.82,and are close to the all-time high of €19.03 reached on 27,December,2007.... |

|

Lusa - Business News - Portugal: Communist party against 'revolving door' politics

Lisbon,April.22,2024(Lusa)-The Portuguese Communist Party (PCP) on Monday called for a halt to the "revolving doors" between public office and private business in the same area... |

|

Lusa - Business News - Portugal: Four universities win €12M from Marie Skłodowska-Curie network

Lisbon, April 22, 2024 (Lusa) - Four Portuguese universities won €12 million from the Marie Skłodowska-Curie Doctoral Action Networks, the highest amount ever, ... |

|

CNA - الرئيس خريستوذوليديس يعرب عن رضاه لدعم الدول الأعضاء في الاتحاد الأوروبي طلب إعادة تقييم المناطق السورية

أعرب رئيس الجمهورية نيكوس خريستوذوليديس عن ارتياحه لدعم الدول الأعضاء في الاتحاد الأوروبي في الاجتماع الأخير للمجلس الأوروبي، لبدء مناقشة إعادة تصنيف المناطق في سوريا على أنها آمنة. ... |

|

Lusa - Business News - Portugal: Port of Lisbon sees more than 700,000 cruise ship passengers in 2023

Lisbon,April.22,2024(Lusa)-The port of Lisbon recorded its best year for cruises in 2023, surpassing the 700,000 passenger barrier (758,328), a growth of 54% compared to 2022,... |

|

Lusa - Business News - Portugal: Criminalise unjustified enrichment, offshore transfers - Left Bloc

Lisbon, April.22,2024(Lusa)- Portugal's Left Bloc political party said on Monday that the criminalisation of capital transfers "to and from" tax havens should be a priority... |

|

CNA - General government records surplus €918.7 mn in 2023

General government results for 2023 indicate a fiscal surplus of €918.7 mn, according to the Statistical Service of Cyprus.

The Statistical Service announced on Monday... |

|

Lusa - Business News - Portugal: Greater Bay allows 'wide access' to China - economy minister

Macau,China,April.22,2024(Lusa)- Portugal's minister of economy told Lusa on Monday that, from the point of view of Portuguese companies, entry into the Chinese Greater Bay Area,... |

|

Lusa - Business News - Portugal: Country hopes to join China's visa exemption group - economy minister

Macau, China, April 22,2024 (Lusa) - Portugal's economy minister told Lusa on Monday that the country would like to be included in the group benefiting... |

|

Lusa - Business News - Mozambique: Gas to improve economy after 2028, tough challenges until then - S&P

London, April,22,2024(Lusa)- The financial rating agency Standard & Poor's said on Monday that Mozambique would see significant gains from the gas projects from 2028 onwards,... |

|

Lusa - Business News - Portugal: Value of pollinators underestimated - researcher

Coimbra, Portugal, April,22,2024 (Lusa) - The importance of pollinators on agricultural production is underestimated, an international study conducted by researchers from the University of Coimbra... |

|

Lusa - Business News - Macau: Portuguese language countries look for China development cooperation

Macau, China, April 22, 2024 (Lusa) - Speeches by member state representatives on Monday at the opening of the organisation's sixth ministerial conference focused on... |

|

Lusa - Business News - Portugal: Room to 'fine-tune' China fund - economy minister

Macau, China, April 22, 2024 (Lusa) - Portugal's economy minister said on Monday that there was room "to fine-tune the regulations" of the China-Portuguese Language... |

|

Lusa - Business News - Cabo Verde: Strong growth in 2023 backed by tourism - IMF forecast

Washington, April,22,2024(Lusa) - The International Monetary Fund (IMF) economist who coordinated the report on sub-Saharan Africa told Lusa on Monday that Cabo Verde recorded ... |

|

Lusa - Business News - Mozambique: Economic growth to remain modest in medium term - IMF forecast

Washington, April 22,2024 (Lusa) - The International Monetary Fund (IMF) economist who coordinated the report on sub-Saharan Africa told Lusa on Monday that Mozambique's growth... |

|

Lusa - Business News - Angola: Economic growth sustained by non-oil sector - IMF forecast

Washington, April,22,2024 (Lusa) - The International Monetary Fund (IMF) economist who coordinated the report on sub-Saharan Africa told Lusa today that Angola's growth this year... |

|

Lusa - Business News - Mozambique: Mine starts supplying graphite to Indonesia battery factory

Maputo, April 22, 2024 (Lusa) - The Balama graphite mine in northern Mozambique debuted this year in exporting graphite to an Indonesian battery manufacturer, ... |

|

Lusa - Business News - Portugal: Guarda conference will discuss new NIS2 cybersecurity directive

Guarda, Portugal, April.22,2024 (Lusa) - A study on the impact in Portugal of the new European directive that implies a large investment in computer security... |

|

Lusa - Business News - Portugal: Fourth largest budget surplus in euro area

Brussels April,22,2024(Lusa) - The eurozone's public deficit fell in 2023 to 3.6% of GDP and debt slowed to 88.6% compared to the previous year, ... |

|

Lusa - Business News - Portugal: Benchmark index up after Galp announces important discovery in Namibia

Lisbon, April 22, 2024 (Lusa) - The Lisbon stock market was trading higher on Monday, driven mainly by Galp shares, which rose 16.61% to €18.71,... |

|

CNA - الوزير داميانوس يشارك في الاجتماع غير الرسمي لوزراء الصحة بالاتحاد الأوروبي

يتوجه وزير الصحة ميخاليس داميانوس اليوم إلى بروكسل حيث سيشارك في الاجتماع غير الرسمي لمجلس وزراء الصحة في الاتحاد الأوروبي.

وفقاً لبيان صحفي رسمي، سيتم خلال الاجتماع مناقشة قضايا مهمة تتعلق بالقطاع الصحي، من بينها أزمة القوى العاملة الصحية وتأمين إمدادات الأدوية والخطة الأوروبية لمكافحة السرطان،... |

|

CNA - السباحة القبرصية بيليندريتو تفوز للمرة الثالثة في الألعاب البارالمبية

فازت القبرصية كارولينا بيليندريتو في السباق الحر 50 متراً في بطولة أوروبا المفتوحة للسباحة لذوي الاحتياجات الخاصة في ماديرا.

بعد سباق ممتاز، قدمت بيليندريتو أفضل ما لديها وحصلت على المركز الأول في نهائي سباق 50 متر. ... |

|

Lusa - Business News - Mozambique: Opposition party supports owner of boat that sank, killing 98

Maputo, April 22,2024 (Lusa) - The president of the Mozambican National Resistance (Renamo) said on Monday that the largest opposition party will give "legal assistance"... |

|

Lusa - Business News - Portugal: Top newspaper headlines on Monday, 22 April

Lisbon, April 22, 2024 (Lusa) - Income tax cuts and the up-coming 25 April carnation revolution celebrations are featured on Monday's front pages in Portugal.... |

|

Lusa - Business News - Portugal: Cartel accusations not substantiated - BCP

Lisbon, Sept.10,2019 (Lusa)–Portuguese bank BCP is to judicially challenge a fine of €60 million imposed by the Competition Authority (AdC) for cartelling sensitive information on housing loans, underlining that the accusations are not adequately substantiated, it announced on Monday.

The bank stressed that throughout this process, initiated by the AdC in 2012, it had the opportunity to provide all the clarifications requested and to explain the reasons why the accusations made against it were not adequately supported and substantiated.

According to the bank, the authority's decision does not show that the information-sharing practices imputed to BCP had any negative effect on consumers.

BCP also added that in the period covered by the decision includes the pre-financial crisis of 2008, in which there were very competitive commercial practices between institutions, to strengthen market shares.

"After 2008, BCP's pricing reflected the generalised increase in credit spreads as a result of the economic and financial crisis and the country's financing conditions," the bank said.

On the other hand, the BCP highlighted, the information exchanged by the marketing departments corresponded to the standard spreads that are disclosed through the general price list and not to the prices that ended up being practised in individual negotiations with customers.

BCP also guaranteed that it is committed to strictly complying with the competition rules.

The Competition Authority sentenced 14 banks to fines totalling €225 million for concerted action on sensitive information on mortgage lending between 2002 and 2013, the AdC said on Monday.

The banks convicted are "BBVA, BIC (for facts practiced by the then BPN), BPI, BCP, BES, Banif, Barclays, CGD, Caixa de Crédito Agrícola, Montepio, Santander (for facts practiced by them and by Banco Popular), Deutsche Bank and UCI", according to the statement by AdC.

The authority stated that the banks participating in the concerted practice exchanged sensitive information on the supply of credit products in retail banking, namely housing loans, consumer credit and corporate credit.

PE/IMYN // ADB.

Lusa

Agency : LUSA Date : 2019-09-11 09:46:00

|